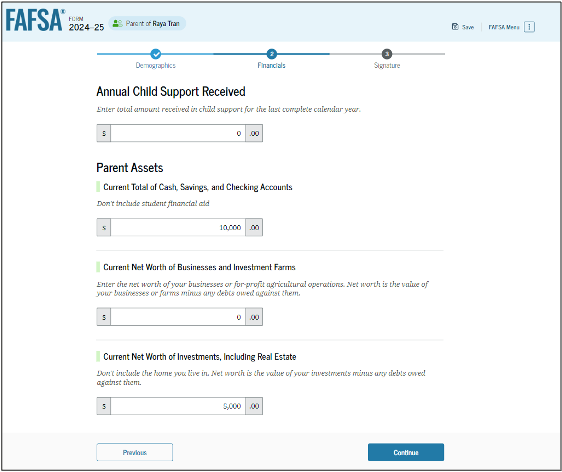

Parent assets reported on the FAFSA impact a student’s aid eligibility. For many families, the amount parents are expected to contribute from assets reported can be as high as 5.64% per year, with a rough average of 5%. The values of any reported assets are the values on the filing date.

There are three notable changes to reporting parent assets on the 2024-25 FAFSA.

1) Child support received

If the parent received child support for any of their children, that amount is now reported as a Parent Asset instead of parent untaxed income.

How does the parent calculate the amount of child support received?

2024-25 FAFSA asks for the total child support received in the full calendar year before the application is submitted. This may not be the same as the 2022 tax year used for the 2024-25 FAFSA. For example, if the parent is completing the asset section in January 2024, then the parent should report the total child support received in 2023, not 2022.

2) Business or farm owners

The net worth of a business or farm of any size is reported under Parent Assets. Previously, if the business or farm employed fewer than 100 full-time employees, that business or farm was exempt from reporting. This is no longer the case. This new requirement will have a large impact on some families.

How does the parent calculate the net worth of their business or farm?

Based on 2024-25 FAFSA guidance, net worth of a business or farm is the value of the business or farm minus (-) debts.

- The value of the business or farm includes the market value of land, building, machinery, equipment, and inventory.

- Debts of the business or farm are only debts where the business or farm was used as collateral.

What if the parent’s business is a services business, e.g., consulting, cleaning, etc…?

Most services businesses do not have tangible assets, like land or equipment, defined in the FAFSA. In this case, the business value may be $0.

3) 529 Plans owners

Starting with the 2024-25 FAFSA, parents should only report 529 Plans that benefit the student applicant. 529 Plans that benefit or are intended for siblings or other family members are no longer reported.

What if the parent has a college pre-paid plan?

College pre-paid plans are treated the same way as 529 Plans. Parents should only report the refund value of the student’s college pre-paid plan.

What are other parent assets reported on the FAFSA?

Reportable parent assets include the following:

- Amount of cash, savings and checking.

- Amount of brokerage accounts, not held in retirement. These may include: money market funds, mutual funds, stocks, bonds, and stock options.

- Certificates of Deposits (CDs).

- Educational savings accounts for the benefit of the student applicant, including: 529 college savings plans, Coverdell savings accounts, and the refund value of prepaid tuition plans.

- Commodities.

- Net worth of second properties. Net worth would be calculated as market value of a property minus (-) any debts owned against them.

What parent assets are not reported on the FAFSA?

Parent assets that should not be reported are:

- Primary home

- Retirement accounts, including: 401k, 403b, IRA, Roth IRA, Keogh plans, pension funds and annuities

- Value of life insurance

- ABLE accounts