IMPORTANT NOTICE:

This calculator has been updated as of February 1, 2024, to incorporate the adjustment for inflation to the Student Aid Index based on the Federal Student Aid’s Final SAI Guide released on January 30, 2024.

What is the Student Aid Index?

For the financial aid award year 2024-25, FAFSA (Free Application for Federal Student Aid) is making several changes to determine a dependent student’s aid eligibility, starting with the calculation of a family’s ability to pay for college.

The new Student Aid Index (SAI) will replace Expected Family Contribution (EFC) as the calculated amount a family is able to pay for college for a given year. Colleges will use SAI in place of EFC in the fundamental equation to determine need-based financial aid eligibility.

Cost of Attendance – Student Aid Index = Financial Need

Your financial need is the same as your need-based financial aid eligibility, but rules on federal student aid plus a college’s own institutional need-based financial aid policies determine your financial aid package.

How is the Student Aid Index calculated?

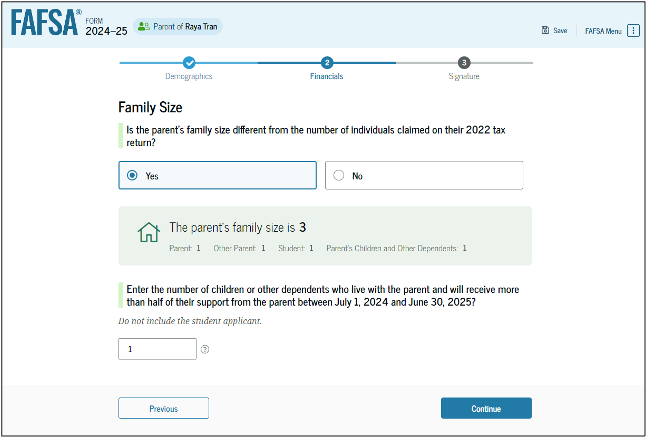

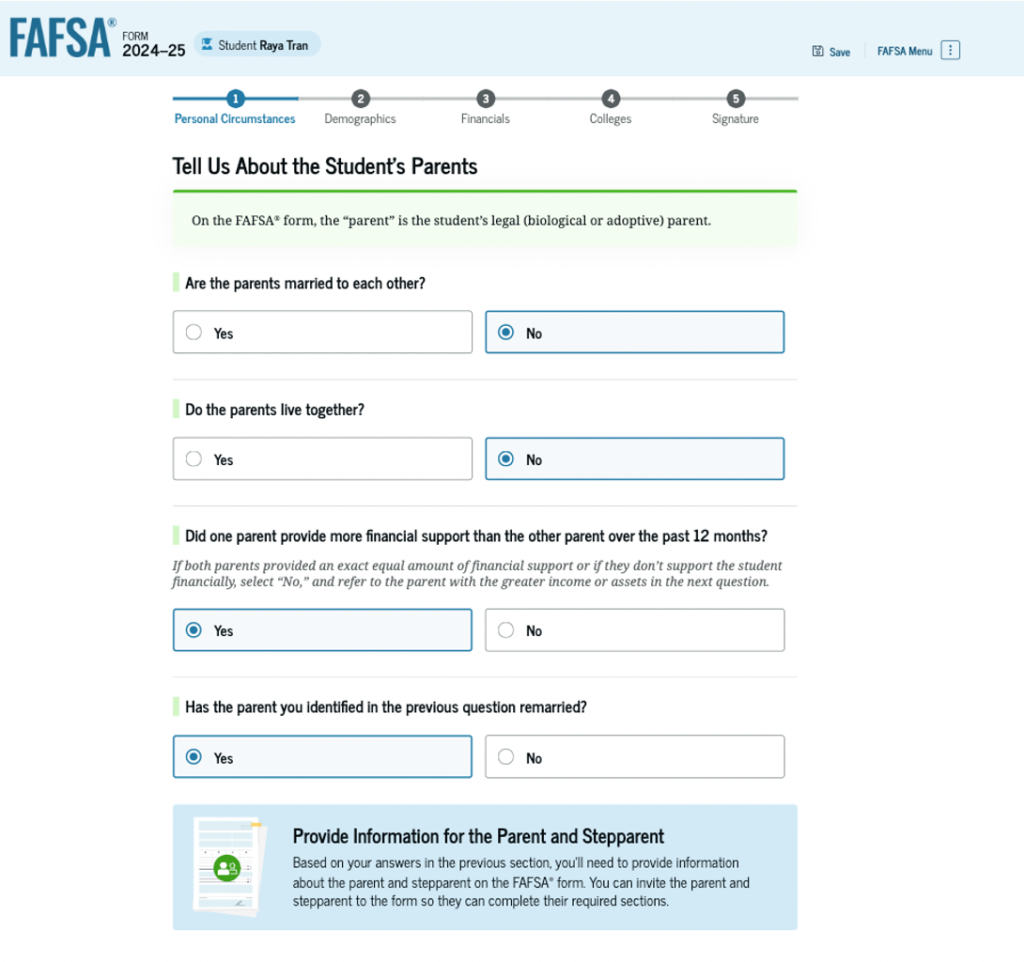

Your family size, parent’s marital status and state of residence, along with four primary financial inputs – 1) Parent 2022 Income, 2) Parent Assets as of filing date, 3) Student 2022 Income, 4) Student Assets as of filing date – will still determine your SAI, or family’s ability to pay. One significant change is the number of students in college will no longer be used in the SAI formula.

Parent Income

FAFSA will rely on 2022 federal tax returns for all parent income, eliminating the reporting of any non-taxed income not reported on your returns. Notably, for parents making pre-tax contributions to employer retirement plans, these contributions amount will no longer count as part of parent income. There will also be a first step to determine whether your student qualifies for an SAI = $0 and the maximum Pell Grant. If your Adjusted Gross Income (AGI) is below a multiple of the Federal Poverty Level income for your state and family size, then your student’s SAI = $0. And, if a parent is not required to file federal tax returns, then SAI = -$1,500. This step is incorporated as part of this calculator.

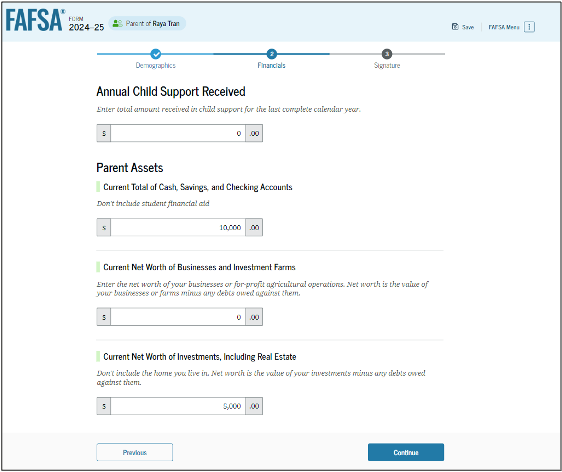

Parent Assets

FAFSA will continue to include all assets a parent owns outside of retirement accounts, a primary home, and life insurance policies. These include checking, savings, CDs, brokerage accounts, 529 or college savings plans, and equity value of second properties.

Two new amounts will be counted as parent assets for the calculation of SAI.

- Child support received. A parent needs to report any child support received in 2022 as an asset at the time of application. It was previously reported as non-taxed income.

- Net worth of business or farm. In prior-year applications, if your business or farm employed less than 100 full-time employees, you were not required to report its net worth. Going forward, the net worth of a business or farm of any size will be reported as a parent asset.

Student Income

FAFSA will provide income protection for students equal to $11,130. In other words, there will be no expected contribution from student income if 2022 is $11,130 or less. For every dollar over this amount, the contribution rate is 50%. Note, if the student qualifies for SAI = $0 based on their parent’s AGI, then any student earnings will not push the SAI over $0.

Student Assets

All assets held by the student outside of retirement are reported. These could include checking, savings, CDs, and brokerage accounts for most students. 529 or college savings plans owned by the student are always reported as a parent asset. The contribution rate for student assets is 20% of every dollar. Again, if the student qualifies for SAI = $0 based on their parent’s AGI, then any assets held by the student will not push the SAI over $0.

2024-25 Student Aid Index Calculator

IMPORTANT NOTICE:

This calculator has been updated as of February 1, 2024, to incorporate the adjustment for inflation to the Student Aid Index based on the Federal Student Aid’s Final SAI Guide released on January 30, 2024.

To calculate your Student Aid Index, you can use values from your parent’s 2022 tax returns and current value of parent and student assets.

How was this calculator developed?

This calculator follows the latest Student Aid Index formula published by the Department of Education in May 2023. You can download the formula sheet here.

Please consider the following when using this calculator.

- Student Aid Index formula exempts reporting parent assets if the parent AGI is less than $60,000 AND either

- Does not file Schedules A, B, C (with a gain or loss greater than $10,000), D, E, F or H.

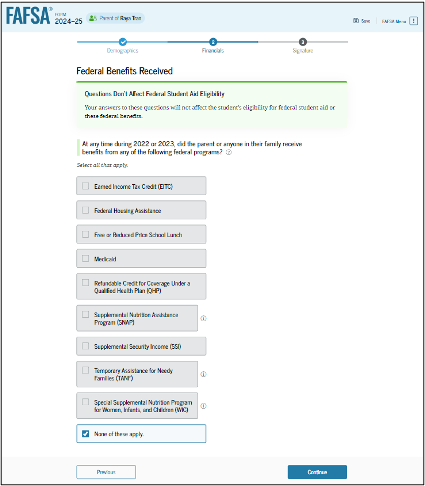

- Student Aid Index formula also exempts reporting parent assets if the parent or student receives any means-tested federal benefit, including:

- Earned income tax credit (EITC)

- Federal housing assistance

- Free or reduced-price school lunch

- Medicaid

- Refundable credit for coverage under a qualified health plan (QHP)

- Supplemental Nutrition Assistance Program (SNAP)

- Supplemental Security Income (SSI)

- Temporary Assistance for Needy Families (TANF)

- Special Supplemental Nutrition Program for Women, Infants and Children (WIC)