Parent assets reported on the FAFSA impact a student’s aid eligibility. For many families, the amount parents are expected to contribute from assets reported can be as high as 5.64% per year, with a rough average of 5%. Given this, the ability to exclude assets from the calculation of the Student Aid Index can be helpful to maximize eligibility.

These are the three scenarios where a parent is exempt from reporting parent assets.

The exceptions to these scenarios are if:

- the parent either lives outside of the US, even when they file US taxes

- the parent does not file US taxes unless they don’t file because their income is below the filing threshold.

In both cases above, the parent will still be required to report parent assets.

1) Student is eligible for the Maximum Pell Grant

Students may be automatically eligible for the Maximum Pell Grant given new rules on parent AGI, family size and state of residence. In the application process, FAFSA will determine whether the student qualifies for the Maximum Pell Grant based on the 2022 AGI shared by the IRS before additional financial information is reported.

Here is the chart with income thresholds by marital status and family size for the lower 48 states.

| Family size/ members of household | unmarried parent with AGI at or below | Married parent with AGI at or below |

|---|---|---|

| 2 | $41,198 | N/A |

| 3 | $51,818 | $40,303 |

| 4 | $62,438 | $48,563 |

| 5 | $73,058 | $56,823 |

| 6 | $83,678 | $65,083 |

| 7 | $94,298 | $73,343 |

| 8 | $104,918 | $81,603 |

2) Combined parent income is less than $60,000

There are actually two parts to this qualification.

- Parents’ 2022 combined AGI (Adjusted Gross Income) is less than $60,000. AGI is reported on page 1 of the 2022 1040 on line 11.

- Parents filing taxes must also meet additional criteria beyond the income threshold. For 2022, parents must not file Schedules A, B, D, E, F, or H or not file a Schedule C with net business income greater than $10,000 of either loss or gain.

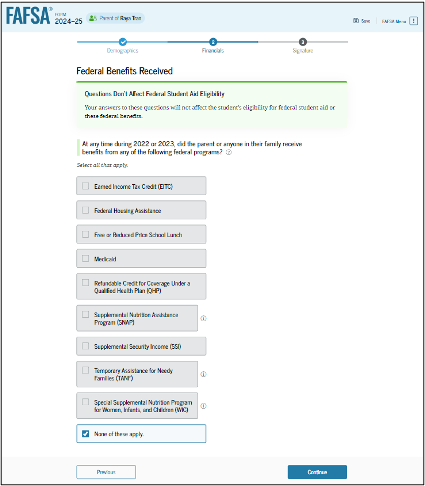

3) Student or parents receive a benefit under the means-tested Federal benefit program during the 2022 or 2023 calendar years.

Programs listed on the 2024-25 FAFSA that qualify are:

- Earned income tax credit (EITC)

- Federal housing assistance

- Free or reduced-price school lunch

- Medicaid

- Refundable credit for coverage under a qualified health plan (QHP)

- Supplemental Nutrition Assistance Program (SNAP)

- Supplemental Security Income (SSI)

- Temporary Assistance for Needy Families (TANF)

- Special Supplemental Nutrition Program for Women, Infants and Children (WIC)